We make sure you're prepared

for any situation

Do I need Trauma cover?

Being able to focus on your recovery after suffering a traumatic event is going to be your primary concern. Having trauma insurance can help relieve your financial worries and allow you to do this.

Here are some answers to questions you may have about trauma insurance.

What is Trauma cover?

Trauma cover pays an agreed lump sum if you suffer a serious illness or injury that is covered in the plan you take out. The lump-sum payment can help you make the adjustments to your lifestyle that you may want or need to make after suffering a traumatic event.

Why would I need it?

Nobody likes to think about the possibility of suffering a serious illness or injury, but you can make plans to help support yourself should the unexpected happen. Trauma cover can provide you with some comfort, knowing that if something does happen, you will have money to help you recover.

As advances in medicine and technology continue, there are a number of illnesses that are being picked up earlier than they previously would have. This does, however, mean that more people are both suffering from, but surviving these events in comparison to the past enabling them to utilise their Trauma Insurance plan to assist with their recovery and the impact of their illness on their lives.

Won’t my private health insurance cover me?

Private Health insurance can help you pay for a certain amount of hospital expenses, medical treatments and some rehabilitation expenses dependent on the extras cover that was chosen by you. However, if you were to suffer a major medical crisis, there are a lot of other expenses that you may need to be able to pay for as well including ongoing treatment needs such as rehabilitation equipment, specialist therapy etc. As you may be unable to work for a period of time and may suffer from financial hardship, you may be unable to cover these extra expenses.

What if I just risk it?

Many people decide not to take out insurance, because they believe ‘it’s too expensive’ or ‘it won’t happen to me’.

Before making a decision it is worthwhile having a look at some of the most common medical ailments suffered by Australians:

- One in two Australian men and one in three Australian women will be diagnosed with cancer before they are 85.1

- Cancer is a leading cause of death in Australia—more than 43,700 people are estimated to have died from cancer in 2011.2

- Ischaemic heart disease was the leading cause of death for both males and females in 2011, followed by Cerebrovascular diseases and Dementia and Alzheimer’s disease.3

- An estimated 275 Australians develop type 2 diabetes every day, with the number of Australians diagnosed with diabetes expected to grow to 3.5 million by 2033.4

Can I take out Trauma cover if I am not working?

Yes, you can take out Trauma cover when you’re not working. This is because the payment of any claim is based on you suffering one of the trauma conditions listed in the plan, rather than your ability to work at the time of taking out the policy.

What conditions will I be covered for?

You should check the relevant Product Disclosure Statement (PDS) to see what conditions you are covered for. Trauma cover will normally cover the most common trauma conditions like cancer, stroke, heart attack and coronary artery surgery.

Talk to your financial planner about the different eligibility criteria required across the industry. This will help you understand when you will be eligible to make a claim.

I already have Total and Permanent Disablement (TPD) cover. How is Trauma cover different?

TPD and Trauma cover are both living insurances. This means the money is paid to you in the event of suffering a serious disability or trauma event.

TPD cover pays claims when you are totally and permanently disabled—mostly this means when you are able to lodge a TPD claim when you suffer an illness or injury that has Permanently Disabled you and it is likely that you will never be able to return to work. Traditionally it also takes a longer period to receive your TPD claim, for example many insurers have a six-month waiting period.

Trauma cover provides cover for major traumatic events like a heart attack, cancer, stroke and coronary bypass surgery. The cover is designed to help you deal financially with your trauma condition, focus on your recovery and return to everyday life.

What type of claims are paid for Trauma cover?

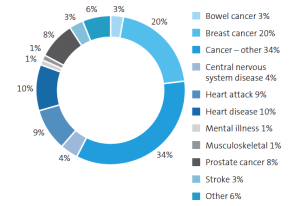

In 2013, AMP paid Trauma claims for these conditions:

Trauma claims by cause

Source: Claims Paid 2013, AMP Life Limited and The National Mutual Life Association of Australasia Limited ABN 72 004 020 437 Claims.

How much cover do I need?

Talk to your financial planner for an assessment of your wealth protection needs. You might want to think about an amount that will cover you for any medical costs, ongoing care needs, along with any other costs of day-to-day life.

Am I covered through my employer’s super fund? Generally, Trauma cover is not available through your super.

How much will it cost?

Your insurance premium will be based on a range of factors such as your age, smoking status, gender, health and the amount of cover you choose. Your financial planner will develop a plan to suit your budget.

How do I apply?

When you apply for Trauma cover you will be required to answer a number of questions on your occupation, health, pastimes and hobbies. This is to assess the risk in providing you with Trauma cover.

Your financial planner will help guide you through the application process.

1 Australian Institute of Health and Welfare, Australia’s Health 2013.

2 cancer.org.au/about-cancer/what-is-cancer/facts-and-figures.html

3 Australian Institute of Health and Welfare (21 June 2013), Media release: Health report card shows a nation where most are healthy, but lifestyle challenges ahead.

4 Diabetes Australia (2013), Diabetes National Election Agenda 2013–2015: Type 2 Diabetes – The 21st Century Pandemic.