We make sure you're prepared

for any situation

Do I need Life cover and TPD cover?

Life cover and Total and Permanent Disablement (TPD) cover provide you with the comfort of knowing that a lump-sum will be paid if you were to die, become terminally ill or, for TPD cover, suffer a long-term disability that prevented you from working. If you were to die, your beneficiaries will receive a lump-sum payment to help them financially.

Here are some answers to questions you may have about Life cover or TPD cover.

What is Life cover?

Life cover pays an agreed sum of money when you die or if you are diagnosed with a terminal illness and have less than 12 months to live.

Why would I need it?

The purpose of personal insurance is to protect dependants from any financial loss arising from the insured person’s death or if they are faced with a terminal illness with less than 12 months to live. If you were to die, you would no longer be able to provide for your family. For example, this could represent food, clothing, education, paying off the mortgage and covering day-to-day expenses.

Who will receive the money?

When you die, the agreed lump-sum will be paid to the person you nominate to receive the money.

How much will I need?

Talk to a financial planner for an assessment of your wealth protection needs. The things they look at could include how much is needed to reduce or pay off your debts, provide for major future purchases, your kids’ education and any other expenses.

How much will it cost?

Your insurance premium will be based on a range of factors such as your age, smoking status, gender, health and the amount of cover you choose. Your financial planner will develop a plan to suit your budget.

What if my circumstances change?

As your life changes, so do your insurance needs. There are particular points in your life like buying property, having a child and getting married, where you will find that your financial responsibilities increase. It is important to review your cover at these times.

Some insurance plans make it easy to increase your cover at key times in your life and you don’t have to provide any additional information on your health status—check the relevant product disclosure statement (PDS) to see if the plan you are applying for has this feature.

What is TPD cover?

TPD cover provides a lump-sum payment if you become disabled and you are unable to work again. TPD plans will also provide payment for other seriously disabling situations, such as loss of sight. You should check the relevant PDS to see if you are covered.

Why would I need it?

A huge emotional strain is placed on a family to provide support to someone who may not be able to work again and requires full-time care. Money is the last thing you would want to think about when faced with a lifelong disability.

How much will it cost?

Your insurance premium will be based on a range of factors such as your age, smoking status, gender, occupation, health and the amount of cover you choose. Your financial planner will develop a plan to suit your budget.

What do I need to think about when deciding which plan is right for me?

An important feature of TPD is the ability to take out cover for your ‘own occupation’ or ‘any occupation’.

With ‘own occupation’ cover you are determined to be totally and permanently disabled when you are no longer able to work in your regular job, even if you might be able to work in another occupation. You might consider this cover if you work in a specialised field. You also pay an increased premium to take out ‘own occupation’ TPD cover.

With ‘any occupation’ cover you are determined to be totally and permanently disabled when you are no longer able to work in any occupation.

Did you know?

The disability rate increases steadily with age, with younger people less likely to report a disability than older people. Of those aged between 25 and 34, 8.6% were affected by disability, compared with 40% of those aged between 65 and 69 and 88% of those aged 90 years and over.1

Can I just rely on my superannuation benefits?

You may have Life and TPD cover through your super fund. If so, make sure you have enough cover and that the type of cover is appropriate for you. Talk to your financial planner about whether having your Life and TPD cover in super is the right option for you. There are some things to think about like tax considerations, and how and when benefits will be paid.

How do I apply?

When you apply for Life cover and/or TPD cover with an insurance company they will require you to answer a number of questions about your occupation, health, pastimes and hobbies. They ask this to assess how much risk there is in providing you with cover.

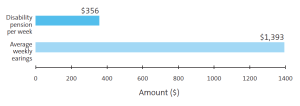

Couldn’t I receive a disability pension?

If you become seriously disabled, receiving a disability pension from the government would provide you with some assistance. You may find that this isn’t enough to maintain your standard of living.

Sources: Centrelink: Disability pension for a disabled person with children at 1 January 2014 is $690 per fortnight (excludes the pensioner supplement of $61.70 per fortnight) ; Australian Bureau of Statistics: Adult weekly ordinary times earnings at November 2013 $1,437.

What type of claims are paid for TPD cover?

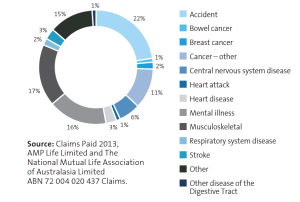

In 2013, AMP paid TPD claims for these conditions:

TPD claims by cause

What type of claims are paid for Life cover?

In 2013, AMP paid Life claims for deaths caused by conditions such as cancer, heart disease, accident, heart attack, respiratory system disease, breast cancer, mental illness, stroke, bowel cancer, central nervous system disease and disease of the urinary system.

1 Australian Bureau of Statistics. Disability, Ageing and Carers, Australia: Summary of findings – 4430.0. 2009.